New ECU branch under construction in Elizabethton

Published 10:35 pm Thursday, April 20, 2023

1 of 6

|

Getting your Trinity Audio player ready...

|

Eastman Credit Union and community officials broke ground on Thursday, April 20, celebrating a future branch location planned to open in early 2024 across from Sycamore Shoals at 1520 West Elk Avenue in Elizabethton.

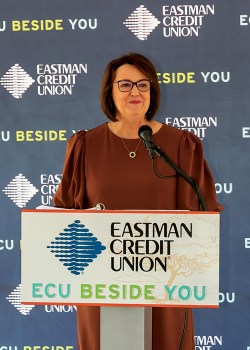

“What an exciting day. We are all eager for this branch. Much work has gone into this site’s acquisition and preparation to get us to this point. We appreciate the hard work of many people whose dedication is making this branch a reality,” said Kelly Price, ECU’s president and CEO.

The Elizabethton branch will have several modern and digital updates. Members will enjoy ECU’s full-service offerings, including teller services, lending and deposit services, and mortgage lending services. It will also include ECU’s new, curbside service in addition to drive-through tellers, a drive-thru ATM, a night depository, and safe deposit boxes. A fresh, updated look and feel will complement these traditional features.

Eastman Credit Union has been steadfast at members’ sides for almost 90 years, helping them build strong financial foundations. Because ECU is a not-for-profit financial institution, profits earned by ECU are returned to members through lower loan rates, better products, fewer fees, and consistently competitive deposit rates. Since 1998, ECU has given back over $177 million to members in the form of an Extraordinary Dividend, which members received for doing business at ECU.

ECU currently offers membership to most counties in Northeast Tennessee, including anyone living or working in Carter County. To learn more about ECU, visit www.ecu.org.

About Eastman Credit Union

Eastman Credit Union, established in 1934, is a not-for-profit financial cooperative headquartered in Kingsport. Serving areas of Northeast Tennessee, Southwest Virginia, and East Texas, ECU is one of the nation’s top 50 largest credit unions. Placing members’ financial needs first, ECU employees focus on exceptional member service and offering products and services that exceed members’ expectations. ECU’s assets are more than $7.5 billion, and the organization serves more than 300,000 members through a network of 34 branches, service centers, and offices; ecu.org; ECU’s Mobile app; ECU’s Card Control app; and over 56,200 surcharge-free ATMs through the Allpoint™ and Presto!® networks. For more information about ECU, visit ecu.org. Funds are federally insured for up to $250,000 by NCUA. Member Equal Housing Lender. Equal Opportunity Employer.