Trustee proposing partial payment plan for property taxes

Published 9:00 am Friday, June 29, 2018

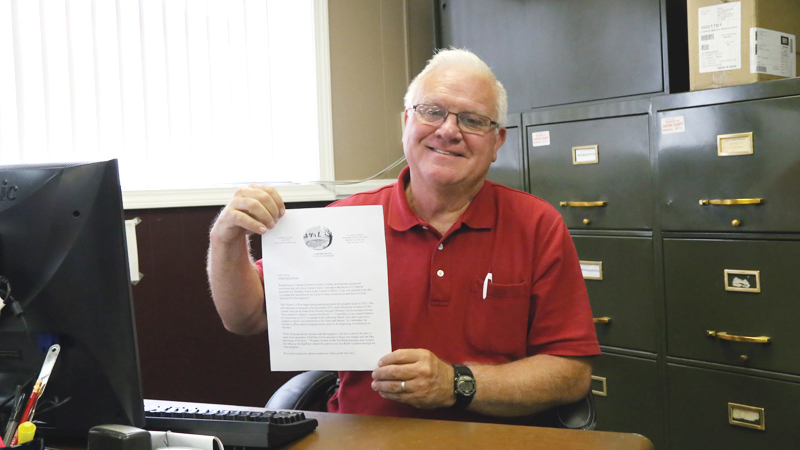

- Star Photo/Abby Morris-Frye Carter County Trustee Randal Lewis, shown here, and his staff have developed a proposed payment plan that would allow property owners to stretch their tax payments over 12 months.

With talks of a possible property tax increase for county residents and concern growing for low-income families who might have difficulty paying their taxes, Carter County Trustee Randal Lewis and his staff have developed a proposal that would allow tax payments to be stretched over a 12-month period.

“I’m excited about it,” Lewis said. “I am very pleased to be able to present this resolution to the Carter County Commission and feel it will be beneficial to the taxpayers.”

Trending

Under the proposal, the policy change would allow the Trustee’s Office to accept a maximum of 12 partial payments for property taxes. In 2012, the Trustee’s Office adopted a policy that allowed residents to pay four partial payments of 25 percent each on their tax bill.

Lewis said he and his staff worked on the policy in response to concerns expressed by local property owners.

“We have had some taxpayers come in and inquire if they can make more payments,” Lewis said.

According to Lewis, he and his staff researched the issue and came up with the proposal to allow up to 12 partial payments.

“With the proposed tax increase and the taxpayers who have asked to be able to make more payments, I feel this will be an asset to those who budget and can take advantage of the plan,” Lewis said.

Under the current partial payment plan, Lewis said if an individual owed $1,000 in property taxes they could make four payments of $250. If the County Commission approves the proposed change to the partial payment plan, that same taxpayer could make 12 payments of about $84.

Trending

Payments on taxes for the current year can be made from October through February with no accrued interest. Taxes unpaid on March 1 accrue interest of 1.5 percent monthly on any outstanding balance to a maximum of 19.5 percent interest in the following March.

“They just pay interest on any balance payments to make after February,” Lewis said.

Any prior year taxes unpaid on April 1 are transferred to the Clerk and Master. Lewis said his office cannot begin accepting property tax payments until the collections period opens in October.

For those county property owners who qualify for the Tax Relief Program, their payment deadline will remain the same for them to use Tax Relief vouchers through the State program. Under the Tax Relief Program, taxes are due to be paid in full by 35 days after the delinquency date.

Lewis said for the proposed partial payment policy to take effect, the Carter County Commission must pass a resolution adopting the proposal as county policy.

Anyone with questions regarding the proposed partial payment plan or the Tax Relief Program can contact the Carter County Trustee’s Office at 423-542-1811.