Davis: No need to ‘panic’ over stock market

Published 9:06 pm Thursday, February 8, 2018

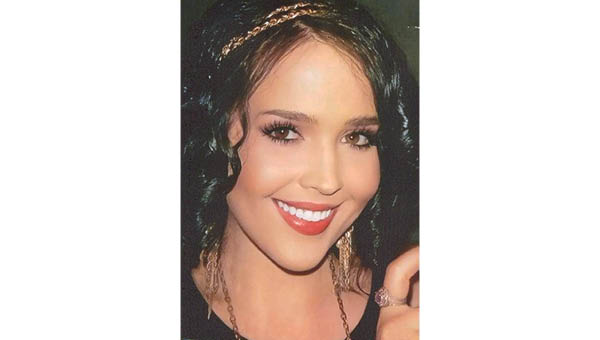

- Star Photo/Curtis Carden Thomas Davis, AAMS, with Edward Jones Investments in Elizabethton said residents should not worry about the trend of the finanical market.

While some concerns grew over the stock market’s Monday decline, one local financial advisor issued a word of encouragement for the current economic situation.

Thomas Davis, AAMS, is a financial advisor with Edward Jones Investments in Elizabethton and was quick to note that the public should not worry about the recent trend.

“Most importantly, don’t panic,” Davis said. “Markets go up and down. This is common. It’s not unusual at all to have a sudden downswing in the market.”

Something different compared to last year’s fluctuation, Davis said, is the perceived size of the market. Going back as far as the 2008-09 financial season, Davis said the perceived size of the downward spiral isn’t as bad as expected.

“We have to remember for over the past eight years, the market has been growing at a record pace,” Davis said. “Naturally, what would follow, would be a record decline, but it’s not.”

According to the financial advisor, Monday’s decline of 1175 points wasn’t even in the top 20 of record declines for the market.

“A 4.6 percent decline in a single day is actually the 33rd when it comes to record drops,” Davis said. “Just like the last time we had this conversation, there are emotional and other impact factors that play into the market, but they aren’t economic. It is important to understand from the data we’ve gathered that this isn’t the end of the market, but rather a speed bump on the road to the next place.”

Davis added a handful of indicators lead experts to believe that it isn’t all doom and gloom.

From inflation to interest rates, wages and unemployment, the financial advisor added that trends are indicating economic growth — which is different compared to other significant declines over the years.

“This isn’t ’08-09 where all things were pointing toward a very bad outcome,” Davis said. “There was no catalyst outside the market that said it will change.”

As far as what’s ahead, Davis said it is always hard to pinpoint due to trends from the public.

“It is hard to gauge because there is that unknown factor,” Davis said. “And that’s people. People are always the variable when it comes to this. When you’ve had eight years of growth, you have to consider why people would do what they do. You’ve got a lot of folks who have changed their retirement plans over the last eight years. If you’re older than about 45, the last eight years have completely changed every expectation. There were people that were going to retire earlier, differently and now they are faced with the possibility of that not being true. I personally don’t believe that, but you can see how they get there.”