Lawmaker seeks to change DUI law

Published 8:48 am Monday, April 13, 2015

One local lawmaker is hoping to change the way the state punishes those residents who repeatedly drink and drive.

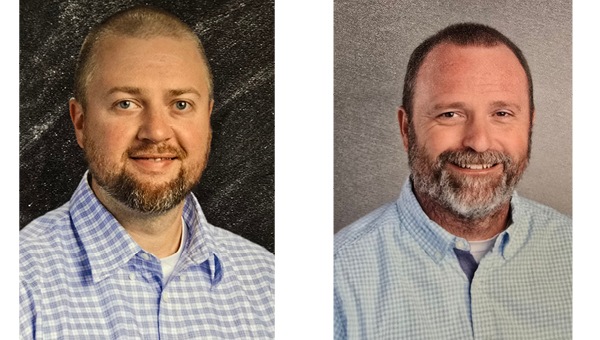

State Rep. John Holsclaw of Elizabethton has introduced a bill in the state legislature that would impose a unique penalty on those who are convicted of a third or subsequent offense of driving under the influence.

In addition to traditional sentencing and fines, his proposal would prohibit them purchasing alcohol for a period of time.

Holsclaw said he was inspired to draft the bill after seeing reports of the same people being arrested over and over for driving under the influence.

“You have people getting arrested for the eighth, ninth, 10th and 11th time for driving under the influence,” Holsclaw said. “At that point, you hear about them killing someone and you wonder why they weren’t stopped. What we’re doing is not working, so I tried to think outside the box to find something that would work.”

The Tennessee Department of Safety estimates there are 900 convictions for third or subsequent DUI offenses in the state each year.

The problem with repeat offenders and impaired drivers on the roadway is still a major issue for the state, Holsclaw said.

“It’s still too common of a problem,” he said. “What’s amazing is how many lives are affected by drunk drivers. Nearly everyone you talk to has been affected or knows someone who has been.”

Under the bill, only those convicted of an alcohol-related DUI offense would be restricted from purchasing alcohol. Those convicted of a third offense could be prohibited from purchasing alcohol for anywhere between five and 15 years. A fourth offense would restrict alcohol purchases by the individual for 10-30 years.

If passed, the law would require the local courts to forward offender’s third of subsequent DUI conviction to the Department of Safety. That individual’s identification card or driver’s license would then be imprinted with the words “No Alcohol Sales.” The additional fee associated with the issue of the specially designated license and identification cards would be at the expense of the offender.

Holsclaw’s bill was introduced to the House of Representatives on Feb. 11. The companion bill in the Senate was introduced the same day by Sen. Frank Niceley, who represents District 8 comprised of Claiborne, Grainger, Hancock, Hawkins, Jefferson and Union Counties.

The House bill was passed by the Criminal Justice Committee and has been forwarded on to the House Finance, Ways and Means subcommittee, where it was placed “behind the budget, meaning the subcommittee will address the state budget and revenues first before considering any items placed “behind the budget.”

Before the month is over, Holsclaw hopes to have his bill pulled out from behind the budget and on the House floor.

On the Senate side, the companion bill was passed by the Senate Judiciary Committee and will be heard by the Senate Finance, Ways, and Means Committee on April 15.

A fiscal memorandum from the Tennessee General Assembly Fiscal Review Committee outlines the projected costs and impacts of the bill if it were to become law:

* The Alcoholic Beverage Commission confirms this bill will have no fiscal impact on departmental operations.

* Any impact to retail sales of alcohol is considered not significant.

* The County Technical Advisory Service (CTAS) confirms this bill will have no fiscal impact on local operations.

* The Department of Safety will incur expenses to develop, manufacture, and issue new license cards with the imprinted words “NO ALCOHOL SALES.” Based on information provided by the department, the one-time increase in state expenditures is reasonably estimated to exceed $90,000. DOS will develop a fee structure to cover the cost to develop, manufacture, and issue new license cards with the imprinted words “NO ALCOHOL SALES.” Any fee structure adopted by DOS is assumed to cover all costs incurred for system modifications.

* Based on information provided by DOS, an estimated 900 third or subsequent DUI convictions are estimated each year.

* If, by rule, DOS sets a fee to recover the $90,000 cost over a 10-year period that additional fee would have to be $11.85 per “NO ALCOHOL SALES” license to provide full cost recovery at a reasonable 4 percent cost of capital rate. Assuming further that this fee is rounded up to $12 per license to simplify those transactions, the estimated additional revenue from 900 “NO ALCOHOL SALES” ID cards/driver’s licenses each year is $10,800 (900 x minimum $12 per card).

* Revenue collected from this additional license fee beyond the initial ten year cost recovery period is assumed to cover any on-going costs related to the program such as maintaining, updating, or replacing the equipment and supplies necessary to issue these specially marked licenses.

* FY15-16 and beyond, DOS’s established fee system will offset any expenditures related to the bill.