State deadline looming for county budget approval

Published 5:37 pm Monday, July 23, 2018

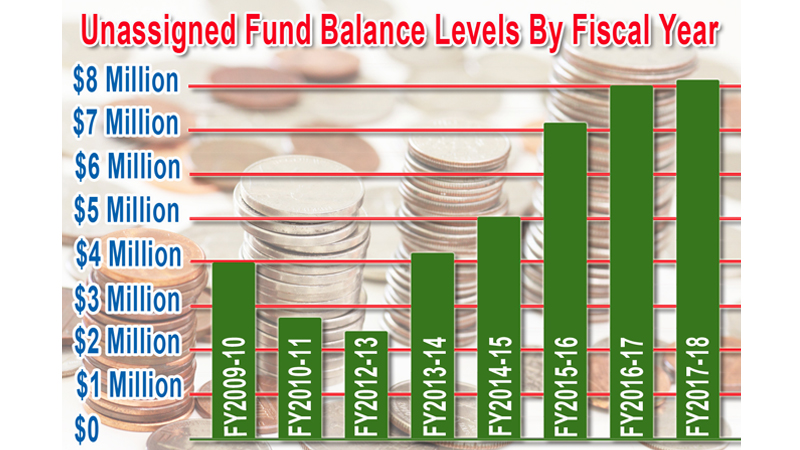

- *data compiled from annual audit reports released by the Tennessee Comptroller's Office.

As the proposed budget and tax rate for the new fiscal year hang in limbo following a veto by the County Mayor, the state-mandated deadline for budget approval is approaching.

On July 16, members of the Carter County Commission approved a budget for the new fiscal year that included an 11-cent property tax increase, bringing the tax rate to $2.58 per $100 of assessed property value. A few days later, Carter County Mayor Leon Humphrey signed paperwork to veto both the county’s appropriations in the budget as well as the tax rate increase.

The ball is now back in the court of the County Commission, which has scheduled a special called meeting on August 6 to address the veto.

During the Commission meeting on July 16, County Attorney Josh Hardin reminded the commissioners they face a deadline from the state in setting the budget and tax rate. The new fiscal year began on July 1, and the county is operating on a “continuing budget” until the new budget is approved.

“We can extend into the months of July and August, but to extend beyond that we have to get a special exemption from Comptroller’s Office and to do that we have to demonstrate extraordinary circumstances, and I don’t think not being able to agree on the budget constitutes extraordinary circumstances,” Hardin said. “If you don’t adopt a budget by that time, the Comptroller’s Office will have to come in and set the tax rate and appropriations.”

If the commissioners do not approve a budget by August 15, Hardin said the county must then submit a letter to the Comptroller’s Office explaining why the county had failed to adopt a budget.

Carter County Finance Director Brad Burke also cautioned the Commissioners about the implications of failing to pass a budget and opening the door for the Comptroller’s Office to set the appropriations and tax rate. Before accepting the position as County Finance Director, Burke worked as an auditor with the Comptroller’s Office for several years.

“They can come in and set the tax rate at whatever they feel is reasonable based on what the officeholders have requested,” Burke told the Commission.

Hardin cautioned the Commission if a budget were not passed in July, there would not be sufficient time for the Budget Committee to draft a new budget proposal, hold the public hearing, present it to the full Commission and to meet all the requirements to properly advertise those meetings to the public before the deadline would pass.

During the special called meeting of the Commission to address the veto, commissioners will have to decide whether to override Humphrey’s veto — which Hardin said could be done by a simple majority vote — or to alter the proposed budget and send it back to Humphrey.

If the budget is not approved by the end of August, it will open the door for the Comptroller’s Office to come in and set the tax rate and budget.

“That would be a disaster,” Burke told the Elizabethton Star.

If the Comptroller’s Office sets the budget, Burke said the state will cut out any funding to non-mandated services as well as funding to outside agencies that are not mandated or contractually obligated — such as the county’s volunteer fire departments, the Carter County Rescue Squad, and other non-profits that provide services to county residents.

“Talk about hurting the taxpayers,” Burke said of the potential cuts, particularly to emergency services like the volunteer fire departments.

The Elizabethton Star reached out to the Comptroller’s Office regarding the looming deadline and what could happen should the state step into the county’s budget process.

“In 2015, The General Assembly passed Public Chapter 170 which gave counties the authority to operate on a continuing budget by operation of law through August 31,” said John Dunn, public information officer for the Comptroller’s Office. “Counties may request approval from the Comptroller for a continuation budget extension through September 30 for extenuating circumstances. We have not approved any extensions since the law was passed in 2015.”

“Because of this law, the Carter County Commission does not have to take a separate action to operate on a continuing basis, as long as they adopt a budget for FY2019 no later than August 31,” Dunn added. “We fully anticipate that all counties should be able to meet this August 31 deadline.”

According to Dunn, state law requires Carter County to maintain a balanced budget throughout the fiscal year because it has outstanding debt.

As far as what the process would be should Carter County fail to adopt a balanced budget by the deadline, Dunn declined to comment on behalf of the office.

“It is much too premature to discuss what any direction from our office in that regard would look like,” Dunn said. “Again, we fully expect Carter County will pass a FY2019 budget by August 31.”