Committee to resume county budget talks on Tuesday evening

Published 6:13 pm Friday, May 25, 2018

Members of Carter County’s Budget Committee will resume work this week on setting a budget for the 2018-19 fiscal year, and the group is facing a decision of whether or not to cut county services or to raise property tax rates.

When the budget requests were submitted to the Committee by the county’s department heads and elected officials, the expenditure requests far exceeded the county’s revenue, leaving a shortfall that would have required a 16 cent property tax rate increase. The current property tax rate is $2.47 per $100 of assessed value. If the Committee had selected to fund all the requests as they were received, the county would have had to set the property tax rate at $2.63.

Trending

They worked to trim down expenditures by asking the officeholders and department heads to make cuts to their budget and also by looking at non-mandated funding.

During a previous workshop session, the Budget Committee decided to cut funding to any non-mandated outside agencies except for the Carter County Rescue Squad and the county’s seven volunteer fire departments — Central, Elk Mills, Hampton, Roan Mountain, Stoney Creek, Watauga, and West Carter. The committee decided to not provide any funding to the Butler Fire Department, which provides assistance to areas of Carter County along the Johnson County border near the town of Butler, due to that agency having surplus funds from last year.

The first round of cuts lowered the tax increase needed to cover the expenses to 10.73 cents. The committee sent the budget requests back to the officeholders and department heads and asked them to cut an additional 10 percent from the non-salary portions of their budgets.

When the budgets were brought back to the committee, some of the departments had been able to meet their request for cuts while others were not.

County Finance Director Brad Burke told the committee those who did not cut budgets said there was nowhere else they could cut funds within their budgets. Burke said he had reviewed the budgets numerous times and didn’t see any “fluff” in them that could be reduced.

The second round of cuts brought the shortfall down further, but a 9.03 cent tax increase would still be needed to cover the expenditures of the county.

Trending

The county faces increased costs beyond their control after seeing a 7.5 percent increase in the cost of providing health insurance for employees as well as state-mandated salary increases for certain elected or appointed officials.

This year, the county is facing more than $42,000 in state-mandated raises for elected and appointed officials, with annual salaries increasing between $3,400 and $4,400. The cost to fund this year’s mandated raises would add approximately half a penny to the tax rate. According to documents obtained from the Carter County Finance Department by the Elizabethton Star, between all of the departments, the county’s cost for health insurance increased by more than $152,000 this year. That increase equates to roughly 1.83 cents on the tax rate.

During the most recent meeting of the Budget Committee, Burke told the group they had a difficult decision they would have to make regarding the county’s budget.

“As I see it, you either have to fund the budget or start sending people home and start cutting services,” Burke said.

Cuts to services could mean fewer deputies for the Carter County Sheriff’s Office answering calls for services, fewer workers with the Highway Department clearing roads when snow falls or storms take down trees and branches over roads, longer waits at county offices to pay taxes or renew vehicle tags, or fewer school resource officers in the county schools.

Over the years, the County Commission has opted to tap into the county’s reserve funds to avoid raising property taxes, according to Deputy Finance Director Michael Kennedy. Last year, the Commission voted to raise the property tax by 2 cents, but they also voted to take a significant amount of money from the fund balance to avoid a larger increase.

That move put the county starting this year’s budget process out in the red, with a property tax increase of 5 cents just to balance last year’s spending with no additional funds to cover this year’s increased costs, Kennedy said.

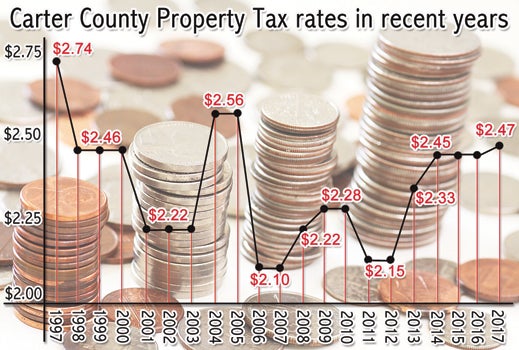

The Elizabethton Star obtained property tax rate information from the Carter County Trustee’s office listing the county’s tax rates going back to 1997. During the years since then, the county’s property tax rate has significantly fluctuated hitting as low as $2.10 and as high as $2.74. Some years saw the county raising property taxes while in other years the Commission voted to lower the tax rate.

In 1997, the county’s property tax rate was set at $2.74. The following year it dropped to $2.46 and remained there through 2000. In 2001, the Commission lowered the tax rate again, this time to $2.22. The rate remained the same for three years before climbing to $2.56 in 2004. The rate remained unchanged in 2005 but dropped dramatically to $2.10 in 2006. The Commission held the tax rate in 2007 but raised it back to $2.22 in 2008. The following year saw another increase, with the tax rate reaching $2.28. The rate stayed at $2.28 in 2010, but in 2011 dropped to $2.15 and remained there for 2012. Then in 2013, the Commission raised the property tax rate to $2.33 followed by an increase to $2.45 in 2014. The $2.45 rate held for 2015 and 2016, before increasing by 2 cents last year to $2.47.

The tax rate is levied per every $100 of the assessed value of the property. Properties are assessed taxes at one-quarter of their appraised value.

For example, if a property is valued at $100,000, the owner only pays taxes assessed on $25,000.

The Carter County Budget Committee will meet on Tuesday, May 29, at 6 p.m. at the Carter County Courthouse. Budget Committee Chairwoman Sonja Culler recently extended an invitation to all of her fellow commissioners asking them to attend the meeting and provide any input they have on areas where the budget may be cut.